BUSINESS

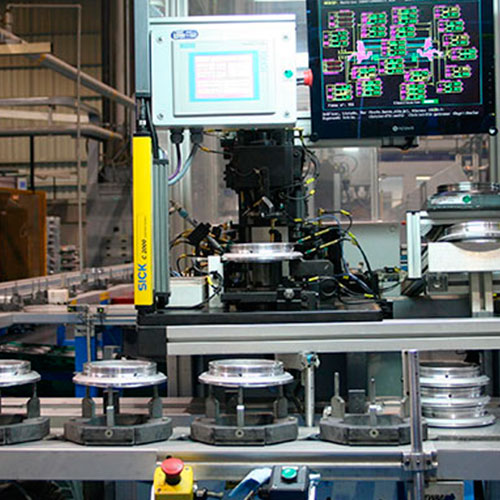

Recyde is a manufacturer of value-add parts for the automotive industry.

DEAL STRUCTURE

Capital increase in December 2004 of € 10 million for a 25% equity stake in the company.

Partnering with founder of Recyde, also Executive Chairman.

INVESTMENT THESIS

Outstanding operator in the sector with superior margins compared to the rest of the industry.

Long-term contracts resulting in stable cash flows.

Ideally positioned and capitalized to take advantage of its operations with international clients and expand into new low-cost markets.

DIANA VALUE-ADD AND DIVESTMENT

Helped identify and value acquisition opportunities in Spain and the Czech Republic that resulted in significant revenue and EBITDA growth

Improved internal controls and reporting tools

Enhanced cash flows through working capital improvements and cash balance management leading to debt reduction

Negotiated sale of 100% the company on behalf of all shareholders

35.9% IRR and 1.9x multiple of capital invested achieved in February 2007